capital gains tax changes 2021

If President-elect Bidens tax plans are implemented it will bring massive change to individuals businesses and estates. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

What S In Biden S Capital Gains Tax Plan Smartasset

President Biden and his administration have long indicated there would be a change coming to the way capital gains are taxed for individuals decedents and even noncorporate entities such as trusts and partnerships.

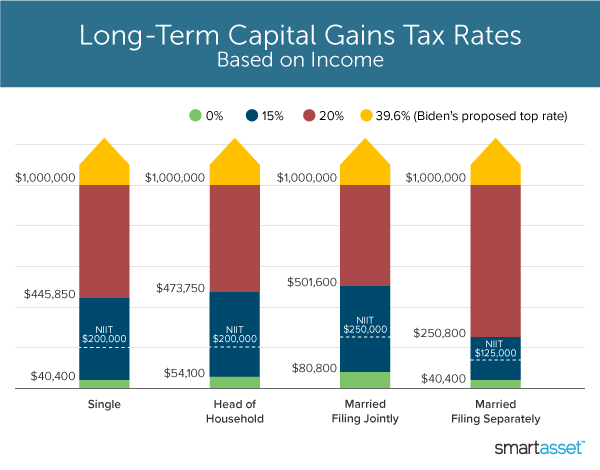

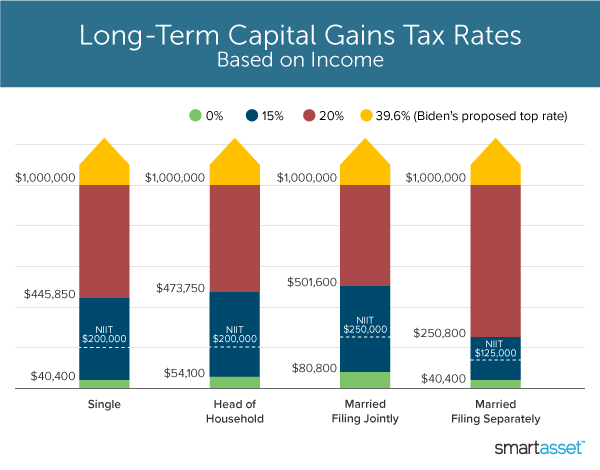

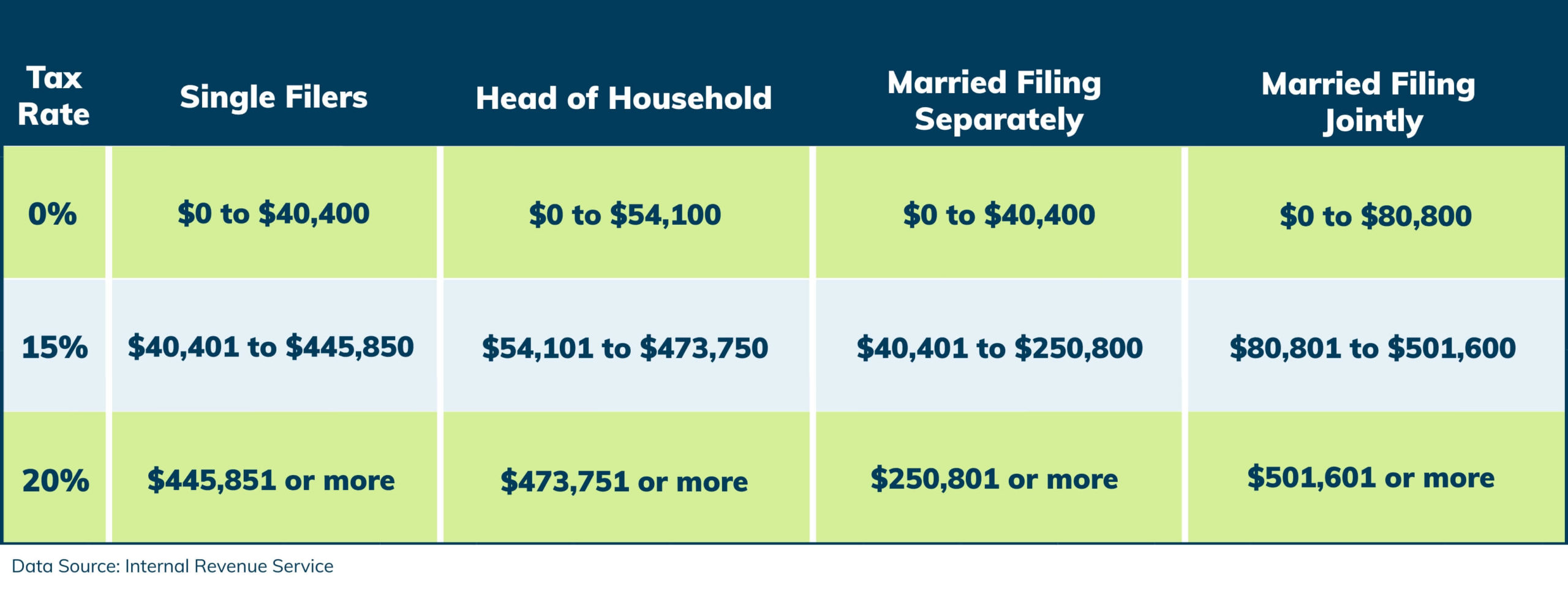

. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate. The new top rate combined with an existing 38 surtax on investment income over certain thresholds. CAPITAL GAINS TAX -CHANGES FOR 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Here is everything you need to know. Single filers with income over 523600.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Your 2021 Tax Bracket To See Whats Been Adjusted. Add state taxes and you may be well over 50.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

For investors who make 1 million or more who are already taxed a surtax on investment income this change could mean their federal tax responsibility could be as high as 434. The effective date for this increase would be September 13 2021. This means that high-income investors could have a tax rate of up to 396 on short-term capital gains.

Following enormous spending in 2020 due to Covid-19 The Government is considering tax increases to raise revenue to mitigate the debt burden and it has been widely reported that Capital Gains Tax is very much at the top of the list and where the Chancellor is seeking to make increases. Capital Gains Tax CGT Changes. For 2021 the top tax bracket includes the following taxpayers.

This tax change is targeted to fund a 18 trillion American Families Plan. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 half of 1000000. The 238 rate may go to 434 an 82 increase.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. First deduct the Capital Gains tax-free allowance from your taxable gain. For investors who make 1 million or more who are already taxed a surtax on investment income this change could mean their federal tax responsibility could be as high as 434.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Ad Compare Your 2022 Tax Bracket vs. Chancellor Rishi Sunak laid out changes to capital gains tax CGT as part of his 2021 Budget delivered on October 27. Long-term gains still get taxed at rates of 0 15 or 20 depending on the.

Heres an overview of capital gains tax in 2021 -- whats changed and what could change. In April 2021 the president addressed the public with a speech and subsequent fact sheet. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Budget capital gains tax CGT. Colorado taxpayers can be exempted from paying state taxes on capital gains in some cases. As proposed the rate hike is already in effect for sales after April 28 2021.

Home Resource Center Proposed Changes to Taxation of Capital Gains. Ad If youre one of the millions of Americans who invested in stocks. Add this to your taxable income.

For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. Discover Helpful Information And Resources On Taxes From AARP. Its one of the biggest tax changes in more than a decade for Colorado.

This tax change is targeted to fund a 18 trillion American Families Plan.

2021 Tax Changes And Tax Brackets

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Capital Gains Tax What Is It When Do You Pay It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Tax Changes And Tax Brackets

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How High Are Capital Gains Taxes In Your State Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)